Impact of foreign trade and remittances along with high rate of dollarization in savings makes exchange rate very important factor for the Armenian economy.

In 2015-2019 AMD has the most stable exchange rate to USD among regional currencies (standard deviation to mean was less than 1%). During 2020, due to Covid-19 and Artsakh war and uncertainty after, AMD depreciated by 8.9% vs USD which was still one of the lowest indicators in the region: GEL: 15%, RUB: 20%, BLR: 24%, TRL: 25%, KZT: 10%. AMD appreciated against USD up to pre-Covid level exchange rate in 2021. More or less stabilized economy and expectations (slowdown of post-war shock) along CBA measures (to mitigate inflation) and increased remittances and export (also due to copper price increase) supported AMD.

Another instability period for exchange rates started in 2022 after the start of Russian-Ukrainian conflict in late February. Most currencies in the region faced depreciation in February-March, mainly brought by depreciation of ruble, but since March 2022, the currencies have appreciated against USD.

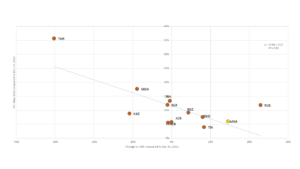

As seen in the graph, there is linear trend between exchange rate and inflation change indicators: the higher depreciation of a currency, the lower inflation.

2022 Exchange rate change and Inflation in the region

The largest outlier in the graph is Russia, where the largest appreciation of the currency accompanies with comparably large inflation. This is because other factors such as sanctions limited import and created deficit.

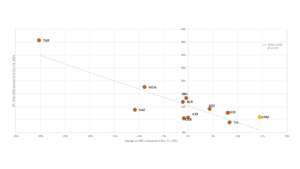

2022 Exchange rate change and Inflation in the region (without Russia)

Without considering Russia (regression is stronger: R2=0.75), Armenia’s inflation is much higher taking into account the trendline for the region. In all other equal, current appreciation of AMD vs USD should have brought to much lower inflation. Higher inflation in Armenia (also in other countries which are above the trendline), speaks about additional inflation influenced by Russian economy