Importance of Momentum for Armenia

Covid-19 outbreak in 2020 have already significantly changed the world economy. Widespread lockdown during at least March-May, 2020, brought to drop of economic activity almost everywhere. The economies which are more dependent from international inflows, like external trade, tourism, remittances are expected to be affected more negatively.

Doing business with and in other countries is vital for the success of companies of nearly all sectors and sizes, and international trade is a key driver for prosperity and economic growth. Countries have developed by establishing competitive export industries, and Gross Domestic Product (GDP) growth has helped to generate financial resources needed to improve people’s living conditions. Firms and countries that open up to trade enjoy long-run growth through several impacts. There is evidence of a market share’s shift towards more efficient exporters, and a direct effect of trade liberalisation on aggregate productivity.

The expansion of international business activities through a multilateral trading system and international policy coordination provided a major pillar for growth in the last decades. According to the RA Government Programme, approved by the National Assembly in February 2019, inclusive economic growth is the main objective of the Government policy for the period of 2019-2024. However, Armenia’s participation in global value chains is low and remains far below the international average. Furthermore, developments in export volumes of goods and services have not been supported by significant improvements in export quality. One of the main drivers for attaining the Government goal thus is to ensure accelerated growth of merchandise and service exports, which is targeted at the level of 40-45% of the GDP at the end of programme period.

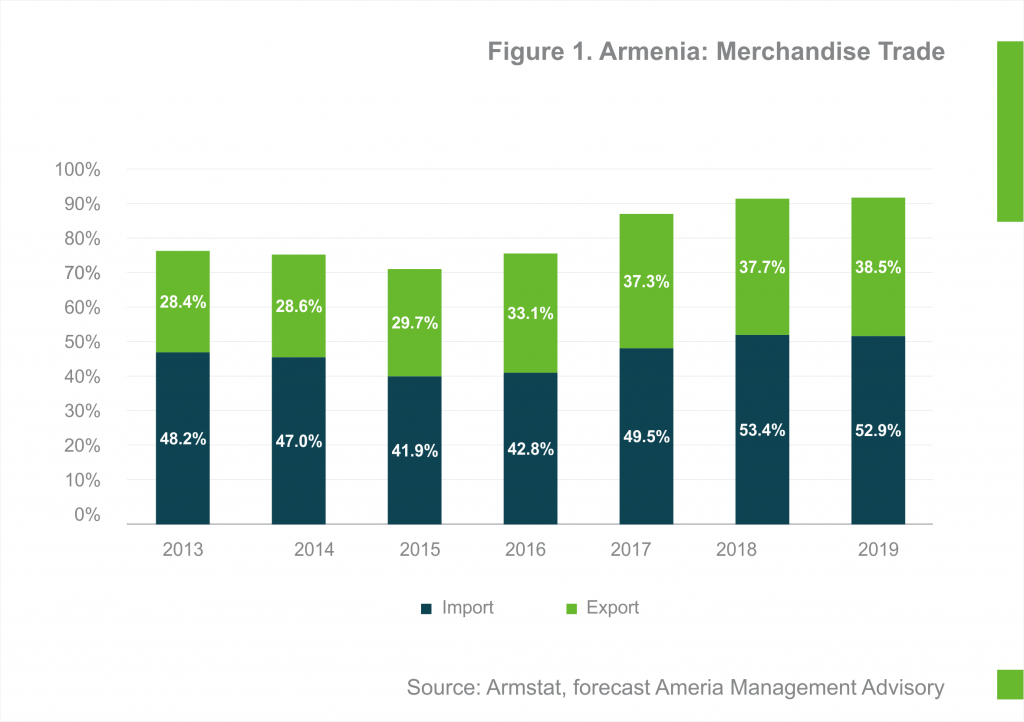

Even if Armenia has small share in global economy and trade due to size of the economy mainly, the country’s economy has large influence of international trade and global international flows (Figure 1). Particularly, export of goods and services (reached 38.5% of GDP in 2019) as well as remittances inflow (10.9% of GDP in 2019) provide large financial inflows into the economy. It is already clear, the Covid-19 situation will change the global economy including global value chains. Armenia has a chance to use this opportunity by quick structural changes in the economy to improve its role in global value chains in order to foster its development. Without quick structural changes the country may appear even in worse situation than before the 2020.

Merchandise Trade

In 2019, merchandise trade turnover reached 8.2 billion USD (Figure 2) growing at a compound annual growth rate (CAGR) of 5.4% during the 2012–2019 period. The share of exports in total merchandise trade also exhibited growth from 24.5% in 2012 reaching 32.4% in 2019. Exports CAGR during that period was 9.7% while the imports CAGR was 3.7%. Anyway, the share of export is decreasing since 2016, when (after large decrease in imports in 2015) the share of exports was 35.4%.

With our baseline scenario for 2020 (which is: Covid-19 pandemic peaks in the second quarter for most countries (including Armenia) in the world and recedes in the second half of this year), we expect moderate decrease in exports (at around 1-2%), while much larger decrease in imports (at around 15%). Larger expectations on decrease in imports are explained by large volume of vehicle imports in 2019, as result of moving to EEAU custom rates since 2020. With this optimistic scenario, concentration of exports will not have large negative impact for 2020, but we believe it may significantly affect the economy after 2020.

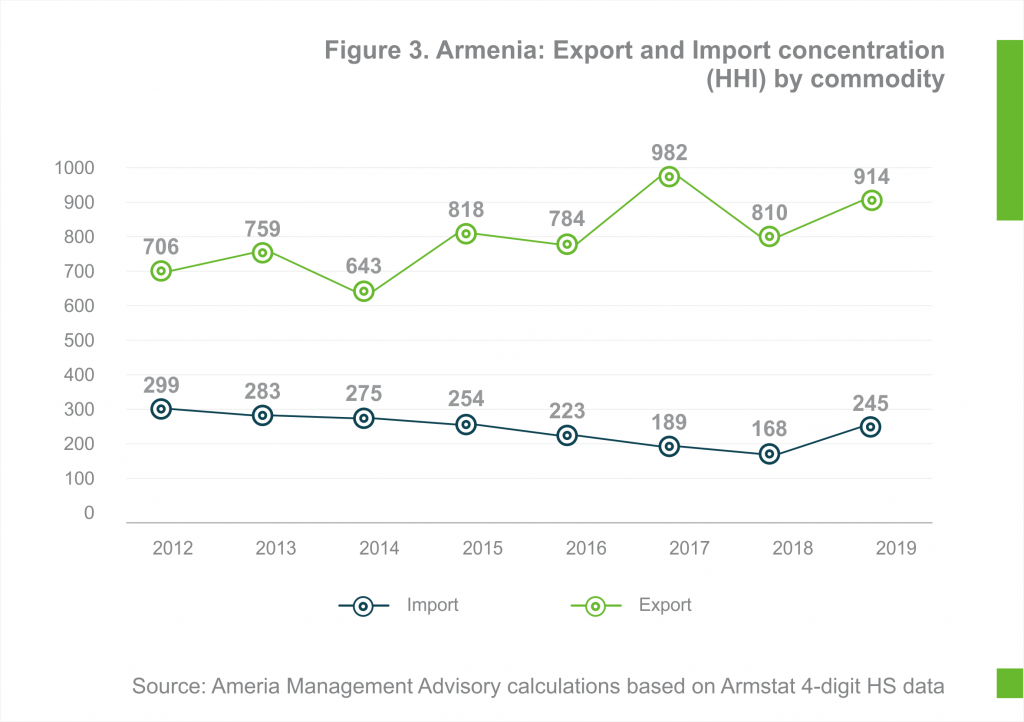

The top exports of the country in 2019 were copper ore ($627M), tobacco products ($273M), hard liquors ($251M), gold ($224M), textile products ($165М), Ferro-alloys ($142M), aluminium products ($100M), waste or scrap of precious metals ($88M) in total contributed to over 70% of exports in 2019. Armenia’s exports are mainly concentrated in the mining sector which contributed around 44.6% of total merchandise exports in 2018. Considering the share of mining and also the share of agricultural products, the Armenian merchandise export is based on extractive sectors, which means that low value added is created in the country.

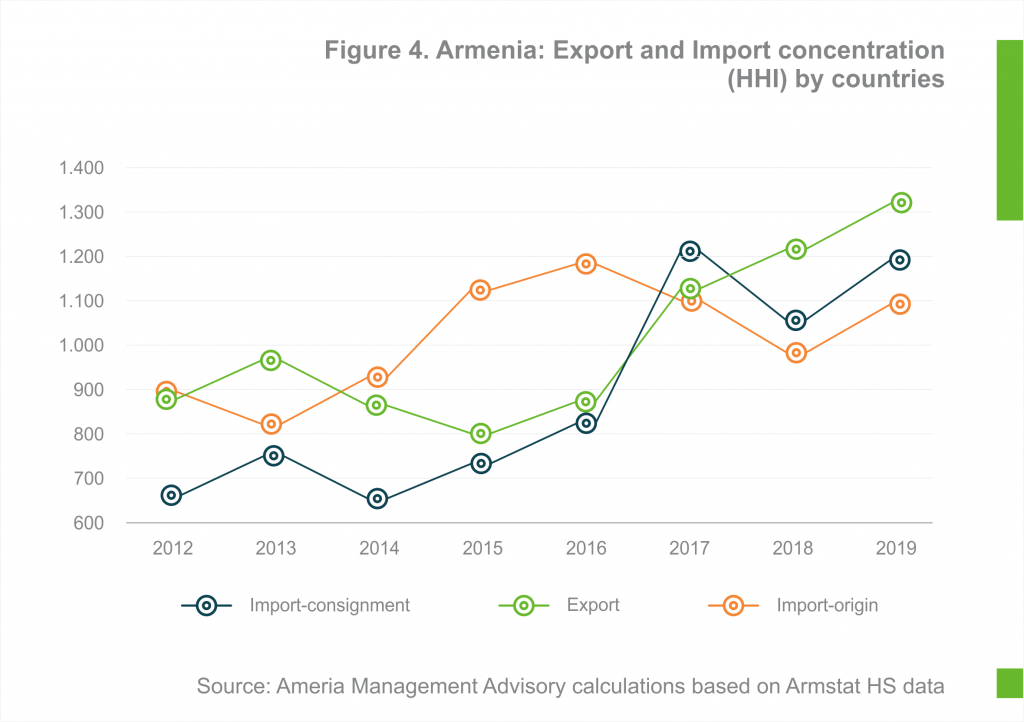

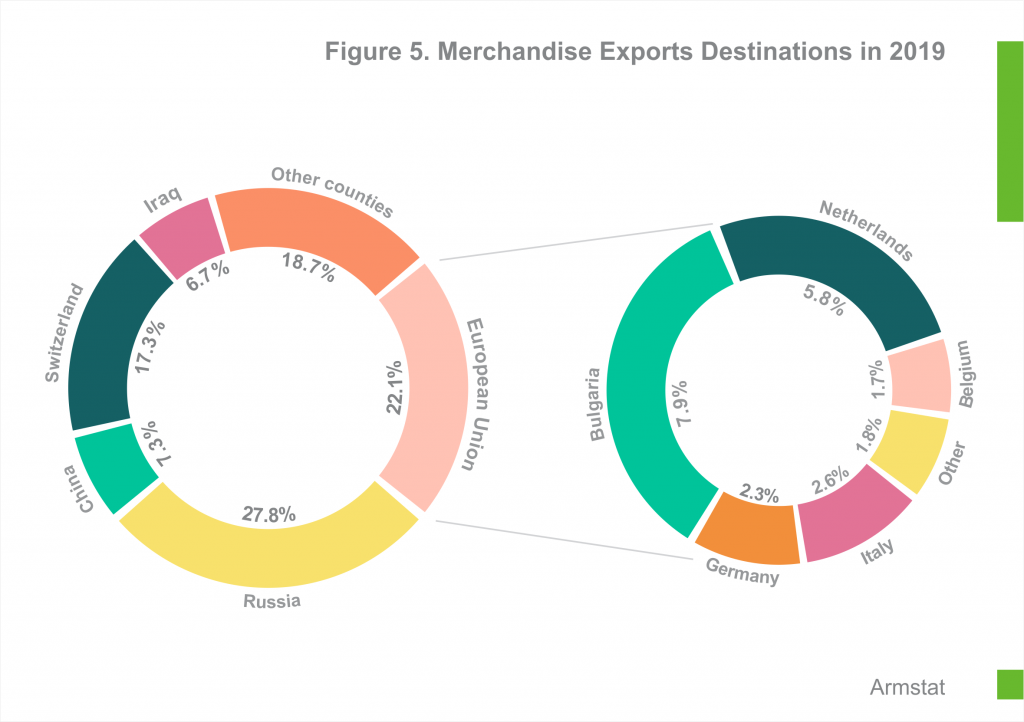

Armenian merchandise export is also highly concentrated in terms of destination. The concentration has been growing after 2015 when Armenia became an EAEU country (Figure 4). Main export destinations for Armenian merchandise exports in 2019 were Russia (27.8%), EU (22.1% more than 6pp decrease over 2018), followed by Switzerland (17.3%), China (7.3%) and Iraq (6.7%), (Figure 5).

Trade in Services

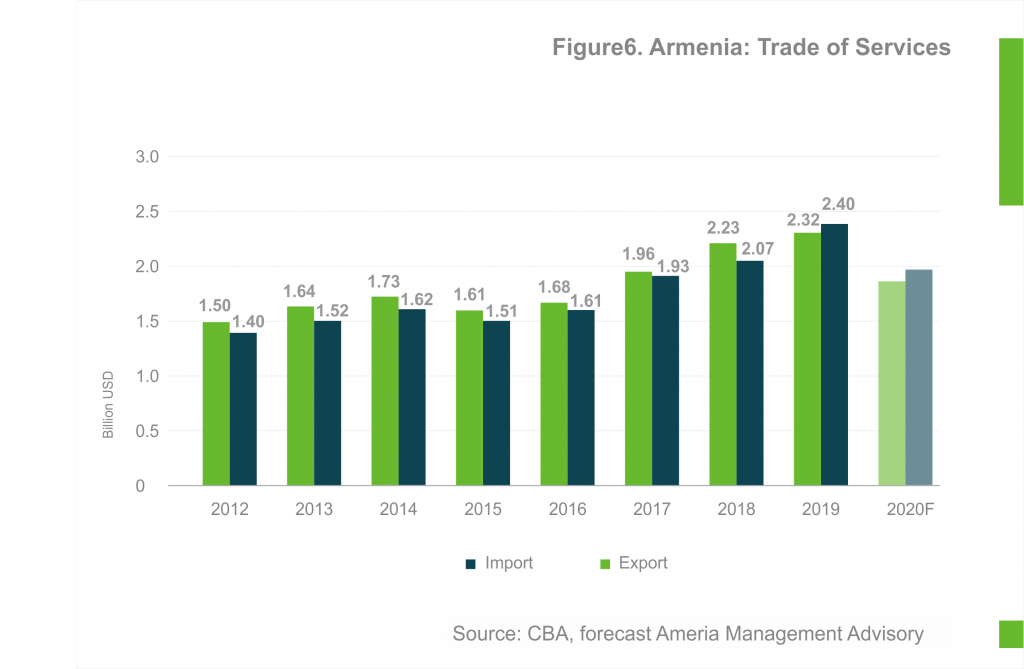

In 2019, services trade turnover reached 4.7 billion USD (Figure 6). Share of exports in total services trade increased to 50.8% in 2019 and first time it was larger than import of services. The services export growth accelerated especially during last three years (2017-2019), with CAGR during that period of 14.3%, while the imports CAGR was 11.4%.

Larger decrease in Service trade is expected during 2020 compared to Merchandise trade, due to larger restrictions in movements of population compared to products. With our baseline scenario we expect at around 18-20% decrease in export and import of services.

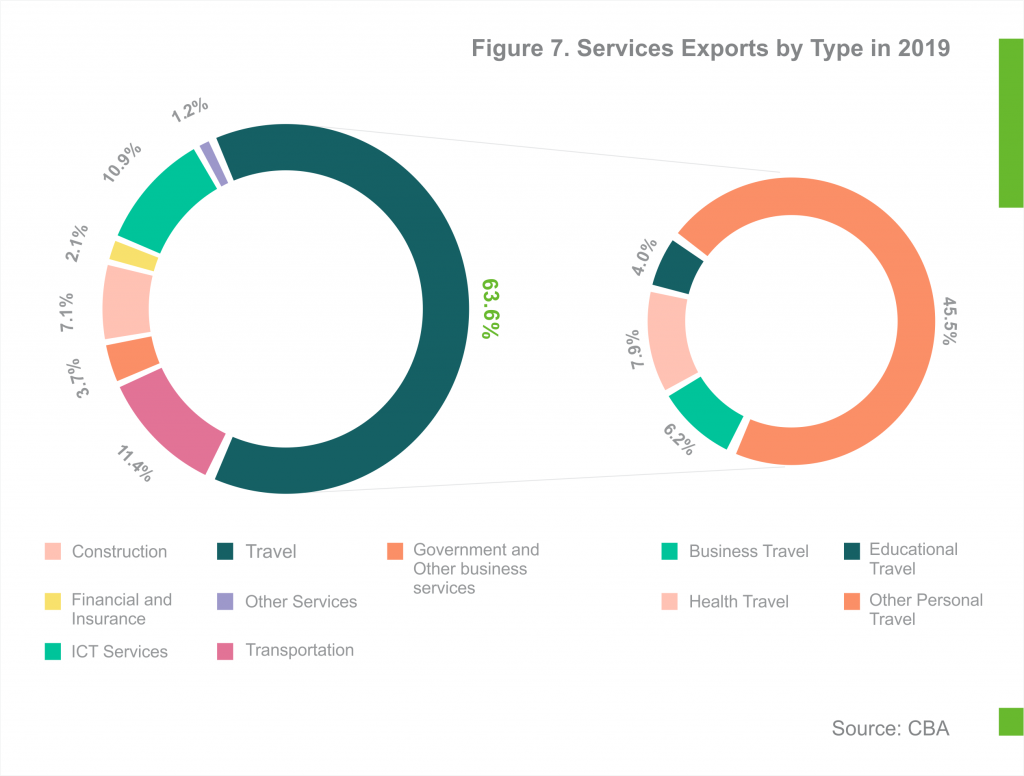

Travel (Tourism) and Telecommunication and IT services (ICT) have the largest influence on increase of service export in Armenia. The share of travel in export of services in 2019 increased to 63.6% against 58.4% in 2018. The share of ICT services in 2019 increased to 10.9% against 7.0% in 2012, but growth slowed in 2019. The structure of service export in 2019 is presented in Figure 7.

The fastest growing service export is in ICT services exhibiting CAGR of 15.1% during the period of 2012-2019. The services export here boomed during 2015-2018 with CAGR of 24.5%, while the growth slowed in 2019 to 4.0% vs 2018. The growth slowdown may have two reasons: first, the volume of sector has increased significantly (around 2.8 times against 2012), and same growth over larger volumes is hard to expect. The second reason, perhaps, is the increase in labor cost in Armenia for ICT services. With some slowdown of ICT service exports in 2019, tourism took the lead in driving export growth. Having quite positive growth during 2012-2019 with CAGR of 9.3%, the sector has accelerated in 2019 to 26.5% growth over 2018.

The inflows from export of travel services into the economy from abroad reached 1.53 bln USD in 2019 (almost twice higher than in 2012). The inflow provided by export of tourism services in 2019 overpassed the inflows from remittances (1.49 bln USD), which have been considered as main source of inflow of financial means into Armenia during last decades. The peak of remittances inflow was in 2013 (2.16 bln) reaching 19.4% of GDP. Gradual decrease of remittances inflow later was compensated by export of travel and ICT services, which was a good sign for the economy and its development.

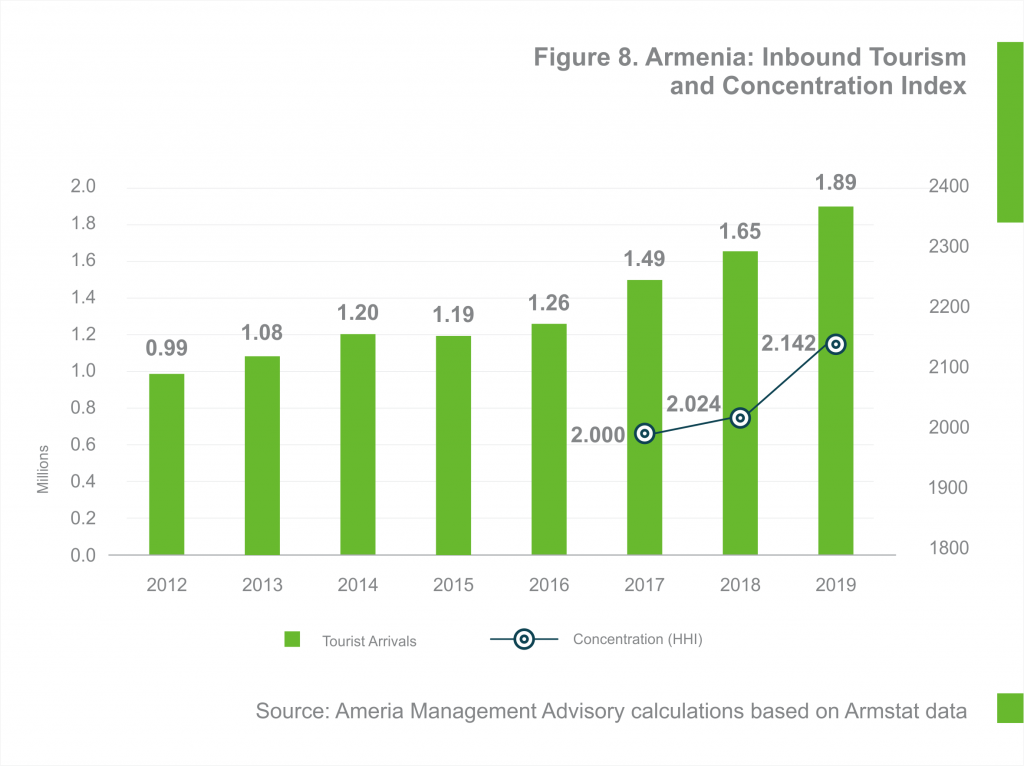

Increase in export of travel services is largely explained by number of tourist arrivals into Armenia (Figure 8). Tourist arrivals almost doubled during 2012-2019. The growth has especially accelerated in last 3 years (with CAGR of 14.6%). It was expected that this trend would have been continued also in 2020 if not the Covid-19 pandemia.

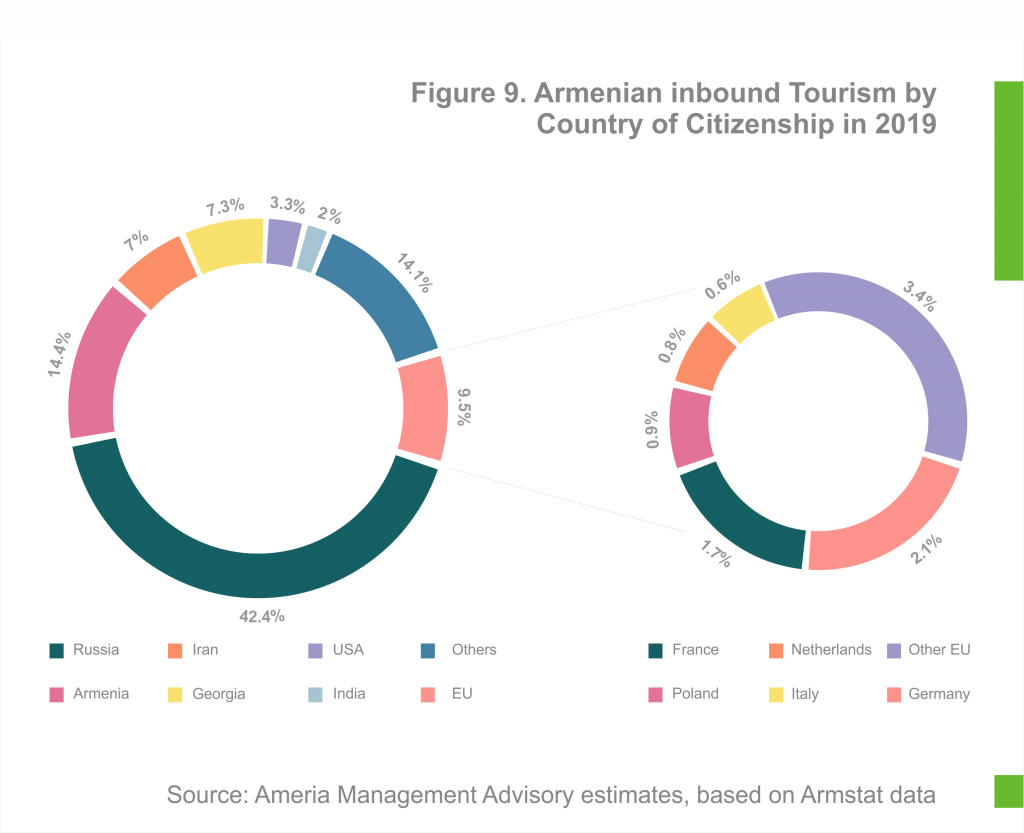

However, with quite impressive increase in export of tourism services, another concentration trend was noticed during recent years also here. We have estimated HHI for tourism arrivals by countries, taking into account a proxy, as there are no data on tourism arrivals by countries. However, since 2017 Armstat publishes numbers of population crossing the border according to their citizenship and also border-crossing numbers by persons. Of course, this estimate may have some discrepancy with actual arrivals from these countries, but what is important, that it shows the trend of concentration (even if it is calculated based on citizenship). The largest share in tourism arrivals have Russia (according to our estimates – 42.4% in 2019). The share of Russian tourists had been increasing during recent years (with our estimates 38.8% in 2018, 36.9% in 2017) which brought to increase in concentration index in tourism. Moreover, 9.8 percentage point of 14.7% growth in tourist arrivals in 2019 was due to Russia (which is over 2/3rd of total growth). Significant number of tourisms are Armenian citizens who live abroad (estimated at around 14.4% of total tourism arrivals in 2019 and over 19% in 2018-2019).

Unfortunately, tourism services export boom was interrupted by Covid-19 outbreak. There is no doubt that remittances inflow will also continue to decrease (especially considering exchange rate of AMD against RUB) as well as other inflows from services (like construction and transportation). The drop in inflows from travel is expected to be more painful for the economy as being on rise it attracted significant investments in sectors towards tourism by the population and businesses. Even with optimistic scenarios, these sectors are not expected to grow within next 1-2 years.

Considering the above-mentioned issues with export components in Armenia, such as low share of value added in country due to large share extractive sector in export, concentration of exports by products and countries which may create risks in the upcoming feature as well as taking into account the current Covid-19 situation, the government needs to initiate an export strategy for structural changes in the economy to support businesses and to ensure sustainable sources for inflows to the economy.